Mexico Imposing A 50% Tariff

Share Article in Social Media

The international shipping industry continues to feel the strain from trade wars, with Mexico imposing a 50% tariff. On December 10, Mexico’s congress agreed to hike tariffs on more than 1,400 imports from China and other Asian nations. Some of the goods subject to tax include automotive parts, steel, furniture, textiles, and plastics. Tariffs on most of these items, previously at 10%, will increase to 35%. Key manufactured goods, such as vehicles, will also see a larger 50% increase. After 75 votes in favor, five against, and 35 abstentions, the new bill will take place on January 1, 2026. These tariffs could significantly affect global trade, particularly the volume of goods imported into Mexico.

Why Is Mexico Imposing A 50% Tariff?

Mexico is imposing tariffs of up to 50% on imports for various reasons, including protecting domestic industries. The country aims to reduce its dependence on imports from countries without free trade agreements. Many of these importers are based in Asian countries, including China, South Korea, Indonesia, India, and Thailand. Mexico’s president, Claudia Sheinbaum, believes that these tariffs will bolster local manufacturing and protect jobs in the country’s economy. She also stated that the duties will reduce trade imbalances and safeguard industries that have declined due to foreign competition. The tariffs will impact nearly 8% of Mexico’s inbound trade and potentially result in over $2.5 billion in 2026.

The US has imposed similar tariffs on imports over the last year to reduce trade imbalances and bolster its economy. When he initially announced the levies, President Trump stated that he wanted to “level the field” by reducing the US trade deficit with its largest trading partners. Despite Mexico’s similar rationale, there is a growing perception that the tariffs also aim to address US concerns that China is expanding its presence in Mexico and using it as a backdoor to North American supply Chains. Mexico’s largest trading partner is the US, and analysts believe a goal is to appease the US. With the 2026 review of the USMCA (US-Mexico-Canada Agreement) approaching, this will be a key topic of discussion.

How Could The Tariffs Affect Shipping?

Although the tariffs could benefit Mexico’s economy, they could strain trade relations, particularly with Asian countries. A Chinese commerce ministry official immediately responded to the tax measures, calling them protectionist and harmful to China-Mexico trade relations. Mexico already has a significant deficit with China, importing nearly $62.1 in the first half of 2025. Similarly, Mexico exported around $4.6 billion to China. China may seek other trading partners, as it did when the US imposed tariffs. With China recently hitting a $1 trillion trade surplus, the country could continue to shift exports away from North America.

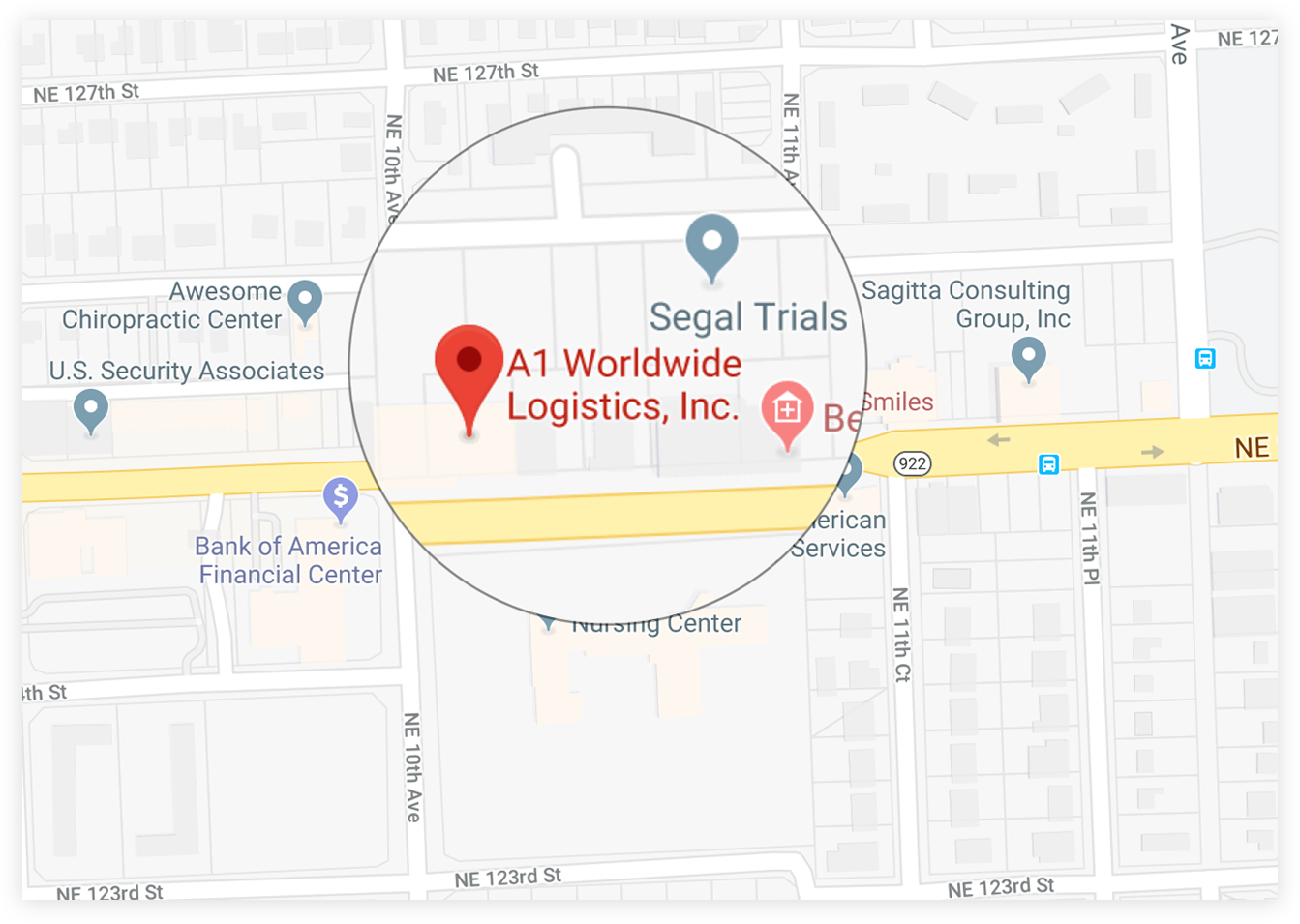

Whether you are importing into the US or exporting to a different country, tariffs can affect the transportation process. While it should not halt cargo flow, shippers should be aware of the impact and take steps to prevent disruptions. In addition to staying current with news and regulations, speaking with freight forwarders can be beneficial. Forwarders are third-party companies that act as intermediaries between shippers and carriers, transporting goods on behalf of the shipper. They do this by coordinating with a network of air, sea, and land carriers. Forwarders also provide services like customs clearance, domestic shipping, warehousing, and more. Reach A1 Worldwide Logistics at info@a1wwl.com or 305-425-9456 to talk to our forwarders about transporting your shipment internationally.

1035 NE 125th St Suite #320, North Miami, FL 33161.

1035 NE 125th St Suite #320, North Miami, FL 33161. a1worldwidelogistics.com

a1worldwidelogistics.com (305) 821-8995

(305) 821-8995 Hours: 8AM - 5PM

Hours: 8AM - 5PM