Trump Doubling Steel Tariffs

Share Article in Social Media

The trade war is continuing, with Trump doubling steel tariffs for imports starting today. An announcement by the Trump Administration on June 30 revealed that steel and aluminum taxes would rise to 50%. Initially, the president imposed a 25% tax on these imports in March, but it was recently doubled. During his first term, Trump levied a similar 25% tariff on steel articles and a 10% tariff on aluminum products. The Biden administration blocked enforcement, citing national security concerns and an adverse effect on domestic steel production. Trump quickly reversed the blockage when returning to office. Due to its usage in various industries, this could have a significant impact on international shipping.

Why Is Trump Doubling Steel Tariffs?

Trump’s goal behind doubling steel and aluminum tariffs is to strengthen domestic industries and address trade imbalances. The original 25% tax increase was to bring the production of raw materials back to the US. Trump recently stated, “We don’t want America’s future to be built with shoddy steel from Shanghai. We want it built with the strength and the pride of Pittsburgh.” The belief is that bringing manufacturing back to the US. would stimulate the economy by creating jobs. Steel and aluminum tariff hikes are also a measure by Trump to combat the importation of low-priced foreign metals. He believes that foreign metal imports make US industries less competitive and pose a threat to national security.

Along with strengthening US steel and aluminum industries, Trump’s proposed 50% tariff is to address unfair trade practices. An example is dumping, which is when a country exports products at a price lower than their domestic market value. This can lead to a trade deficit for the importation of goods such as metals. Trump plans to “level the field” by reducing the trade deficit with the US’s largest trading partners. A similar tariff on all imports from the European Union (EU) is set to take effect on June 9. The president is also promising a $2.2 billion investment by Nippon in the US Steel’s Pennsylvania plant.

What Can The Tariffs Mean For Shipping?

Due to the volume of steel and aluminum imports into the US, a 50% tariff would significantly impact international shipping. The costs of importing metal into the US could rise. Costs would affect other parts of supply chains, including domestic shipping for picking up cargo from ports. Although Trump’s goal is to bring manufacturing back to the US, steel and aluminum-reliant industries may face higher costs. Industries such as construction, automotive, and manufacturing could also feel the strain of having to reorient their supply chains domestically. Trading partners may also retaliate by imposing their tariffs on US imports.

Importing cargo into the US during a time of tariff increases can be demanding for shippers. Although tariffs should not stop you from importing, the shipper should take the proper steps to protect their cargo. It can be beneficial to consult with a 3PL (Third-Party Logistics) provider, such as A1 Worldwide Logistics, when starting. 3PLs are service providers that assist with various aspects of the supply chain. Some of the solutions they offer include freight forwarding, customs clearance, warehousing, and more. They also guide the shipper on the best course of action to protect their shipment. Speak to our brokers and forwarders at info@a1wwl.com or 305-425-9752 for assistance with the importation process.

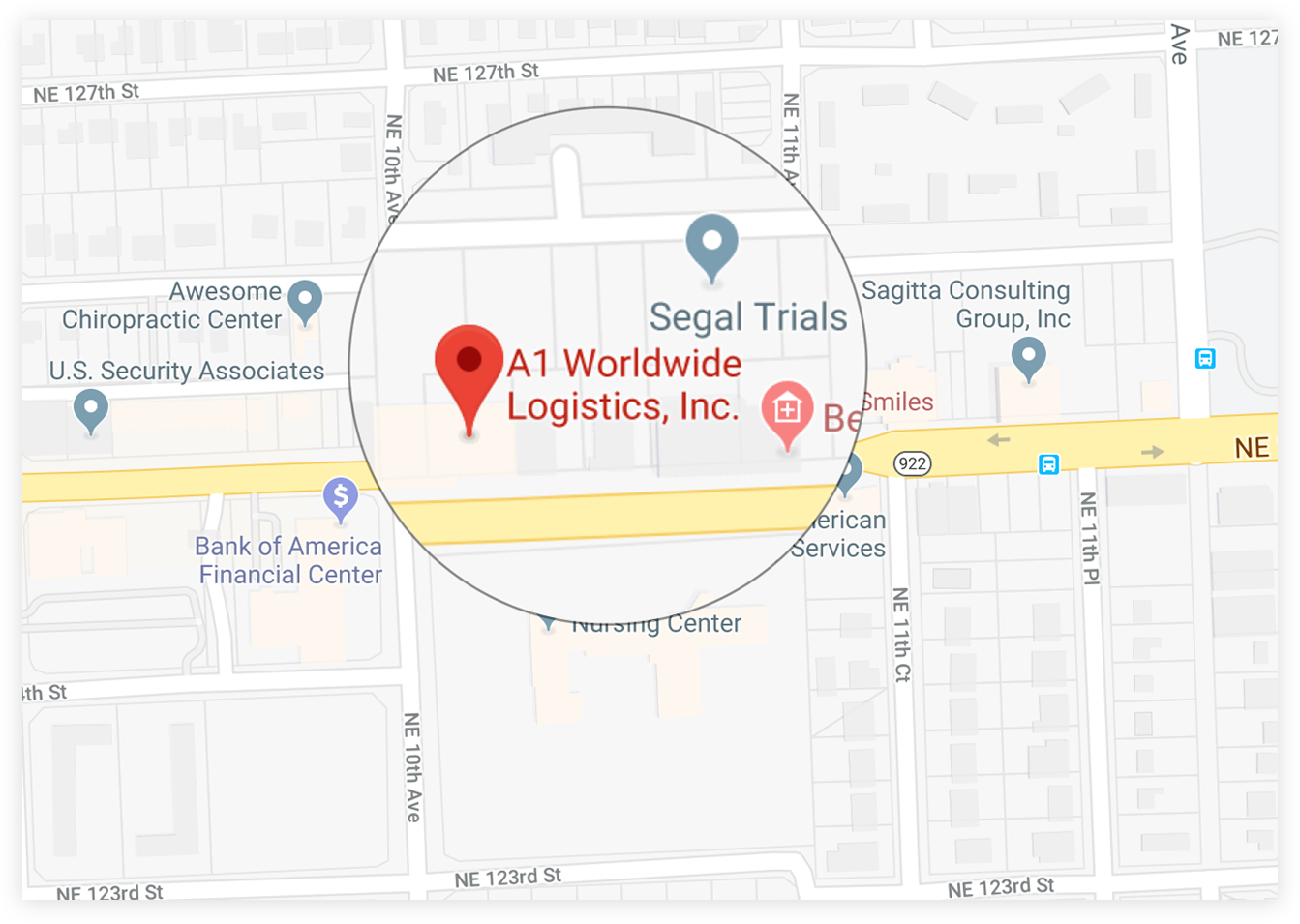

1035 NE 125th St Suite #320, North Miami, FL 33161.

1035 NE 125th St Suite #320, North Miami, FL 33161. a1worldwidelogistics.com

a1worldwidelogistics.com (305) 821-8995

(305) 821-8995 Hours: 8AM - 5PM

Hours: 8AM - 5PM