Supreme Court Arguments Starting

Share Article in Social Media

A legal dispute between President Trump and the US appeals court continues, with the Supreme Court arguments starting today. The Supreme Court heard a case regarding Trump’s IEEPA (IEEPA Emergency Economic Powers Act) tariffs. Two federal courts have recently ruled the levies illegal after a 7-4 decision. The ruling was that Trump exceeded his authority and could not issue tariffs without explicit congressional approval. Oppositely, the Trump Administration argued that the levies are justified under the IEEPA, citing national security as a reason. After the ruling, the president requested an immediate review, and the Supreme Court agreed to an expedited timeline. The case will also concern specific tariffs that Trump imposed on imports from China, Mexico, and Canada.

What Happened During The Oral Arguments?

During the oral arguments, the Supreme Court heard statements from representatives on both sides of the tariffs issue. Solicitor General D. John Sauer argued first on behalf of the Trump Administration. His primary argument was that the tariffs were not designed to raise revenue but to regulate foreign powers. He noted, “The fact that they raise revenue is only incidental.” His argument received an objection from Justice Sonia Sotomayor, noting how President Trump boasted about the tariff’s revenue multiple times. Justice Elena Kagan further noted how the power to tax and regulate foreign commerce belongs to Congress, not the president. Roberts also pressed the court on whether tariffs on imports are an executive power or belong to Congress.

The Supreme Court also heard the argument challenging Trump’s tariffs. Neil Katyal, a lawyer for small businesses against the levies, argued that Trump’s interpretation of IEEPA is flawed. Katyal also stated, “Tariffs are taxes. They take dollars from Americans’ pockets and deposit them in the US Treasury. Our founders gave that taxing power to Congress alone.” During the hearing, various justices questioned whether the reasons for imposing the tariffs met the threshold established under the IEEPA. Some of these reasons include trade deficits and the importation of drugs. The tariffs will remain in place while the final decision is expected to be made in mid-2026.

What Could Shippers Expect As The Supreme Court Arguments Start?

With the oral arguments beginning, shippers should be aware of how the outcome will impact their shipment. If the Supreme Court rules in favor of Trump’s tariffs, the cost of importing into the US could increase. Presidential powers could also expand if the levies remain in place, allowing for unilateral tariff enforcement. If the court strikes down the tariffs, importers may be eligible for billions in refunds. A ruling against the tariffs could also reduce the presidential powers. Even if the court rules the levies illegal, Trump has other options for imposing taxes allowed by Congress. The Supreme Court’s final ruling on the case could be expected before the end of June 2026.

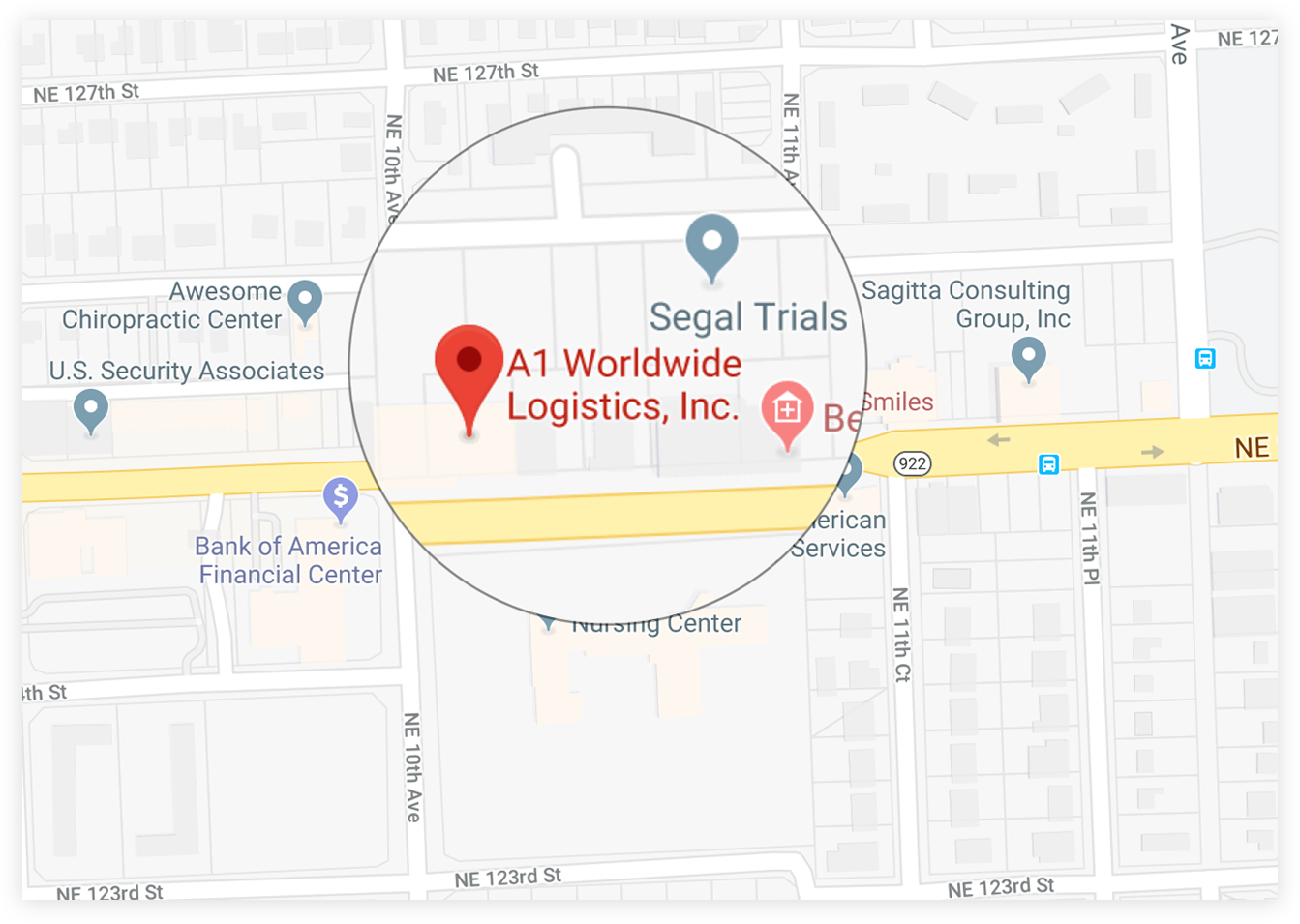

Although the Supreme Court’s ruling will have a significant impact on shipping, it should not halt cargo movement. Shippers should, however, take the necessary steps to prevent potential supply chain disruptions and successfully transport their cargo. In addition to staying current with regulations, speaking to a customs broker is an ideal way to prepare. Brokers are licensed professionals who facilitate the clearance of imports across the country’s borders. They accomplish this by providing services such as calculating duties, preparing documents, filing entries, offering consultation, and more. In the US, they ensure compliance with the CBP (Customs and Border Protection). Contact A1 Worldwide Logistics at info@a1wwl.com or 305-425-9456 to speak to our brokers regarding importing anywhere internationally.

1035 NE 125th St Suite #320, North Miami, FL 33161.

1035 NE 125th St Suite #320, North Miami, FL 33161. a1worldwidelogistics.com

a1worldwidelogistics.com (305) 821-8995

(305) 821-8995 Hours: 8AM - 5PM

Hours: 8AM - 5PM