Trump Imposing A 104% Tariff

Share Article in Social Media

A trade war continues with Trump Imposing a 104% tariff on Chinese imports. Starting today, April 9th, all goods coming into the U.S. from China will see a 104% tax hike. The components of the tariff include:

- A 20% tariff that Trump recently placed on Chinese imports.

- A 34% extra reciprocal tax mirroring China’s current tax on U.S. imports.

- A new 50% retaliatory tariff in response to China’s reciprocal 34% tariff on the U.S.

In response to the tariff, China announced an 84% tax on U.S. goods and accused the U.S. of “bullying practices.” These tariffs could significantly impact international shipping due to the amount of goods shippers import from China to the U.S.

Why Is Trump Imposing A 104% Tariff?

The goal behind Trump imposing a 104% tariff is part of a broader strategy to reduce trade imbalances. Trump recently affirmed, “We’ve been ripped off for years, and we’re not going to be ripped off anymore.” On April 2nd, President Trump declared “Liberation Day,” announcing tax hikes on nearly all of the U.S.’s trading partners. Starting on April 5th, all importations into the U.S. saw a 10% tax increase. Country-specific levies began on April 9th, including China, which responded by enforcing a 34% tax on U.S. goods. In response, the U.S. released a 50% tariff on China, pressuring them to remove their tariff. China further escalated by stating that tariffs on U.S. goods will rise from 34% to 84% on April 10th.

Another reason behind the tariffs is to bring manufacturing and businesses back to the U.S. from other countries. Trump believes this will stimulate the U.S. economy by creating jobs; however, economists note this would have the opposite effect. Shippers who import and export from the U.S. feel this will significantly impact supply chains. With tariffs potentially raising the cost of shipping internationally, the costs could fall on the customer. It would also be challenging, costly, and time consuming to restructure supply chains back to the U.S. President Trump expressed a willingness to negotiate the tariffs but said that thy will remain for the time being.

Will the Tariff Lead To A Larger Trade War?

As countries like China respond to U.S. tariffs, there is a fear that a larger trade war could soon happen. The EU responded to Trump’s “Liberation Day” by warning of possible counter-measures including $28 billion in tariffs on U.S. goods. Countries like Canada and Mexico announced potential duties on U.S. exports like agriculture, dairy, and steel. As other countries begin to retaliate, it could further escalate the trade war and disrupt global supply chains. Along with driving up costs for customers and businesses, it will have greater industry-specific impacts.

While an import tariff will have significant implications for international shipping, it should not stop you from importing. However shippers should take steps to avoid potential disruptions in their supply chains. Along with being current with news that may affect your shipment this can be done by contacting a 3PL provider. 3PL’s (third-party logistics) are service providers that assist with various aspects of supply chain. Some of the solutions they offer include freight forwarding, customs clearance, trucking, warehousing and more. They are also with you throughout the shipping process until the goods reach their final destination. To speak to a 3PL provider about shipping to and from the U.S., contact A1 Worldwide Logistics at info@a1wwl.com or 305-440-5156.

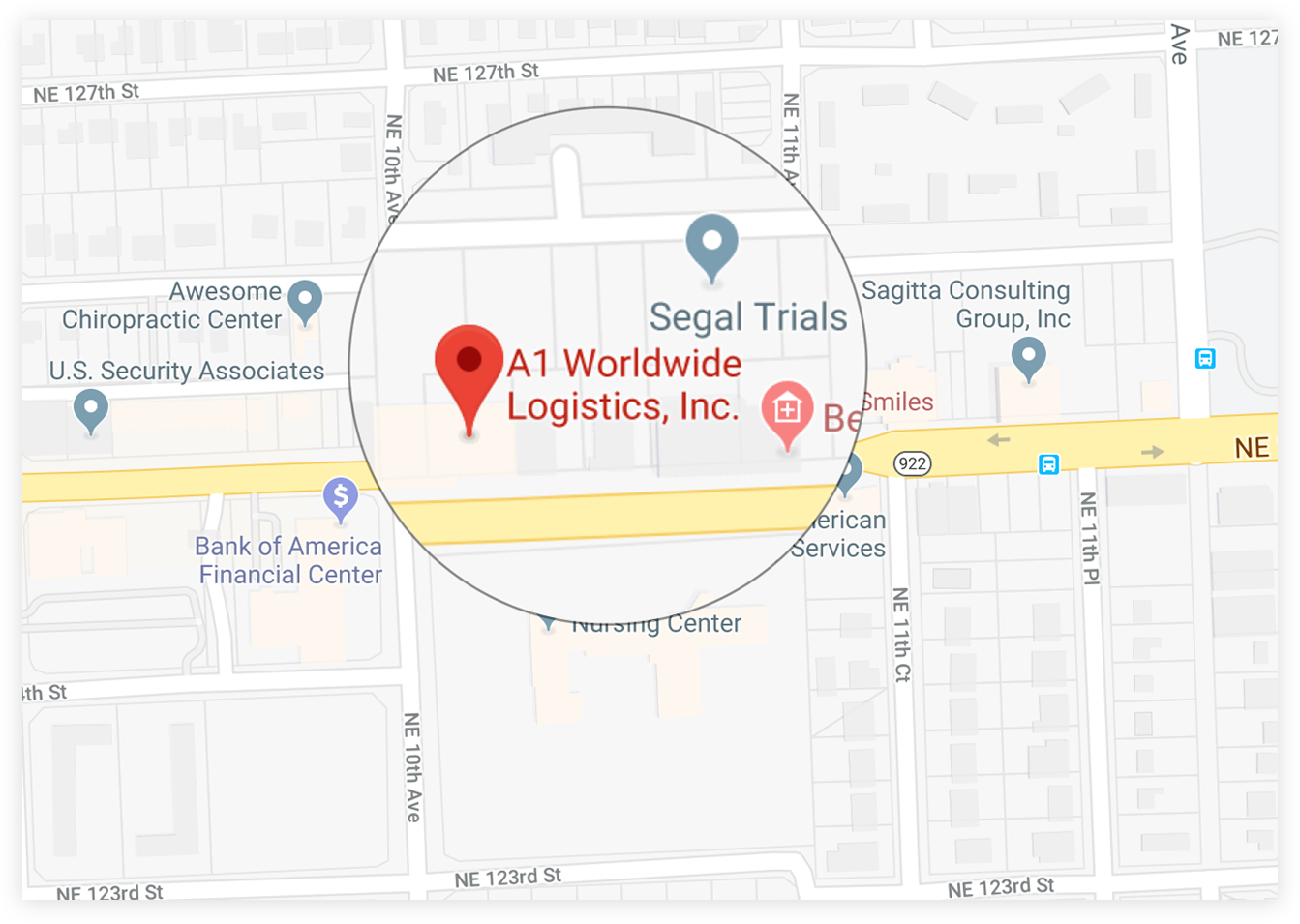

1035 NE 125th St Suite #320, North Miami, FL 33161.

1035 NE 125th St Suite #320, North Miami, FL 33161. a1worldwidelogistics.com

a1worldwidelogistics.com (305) 821-8995

(305) 821-8995 Hours: 8AM - 5PM

Hours: 8AM - 5PM