Tariff Increase On Imports

Share Article in Social Media

The Biden Administration has finalized a tariff increase on imports from China starting September 27th. On May 14th, the USTR (United States Trade Representative) announced adjustments to Section 301 tariffs after a four-year review. These tariffs fall under the Trade Act of 1974, a law promoting fair international trade. In particular, section 301 allows the president permission to adjust tariffs to retaliate against foreign trade barriers. The finalized increase will see a hike in tariffs for electric vehicles, batteries, solar panels, semiconductors, and more imports. While the U.S. will phase out the tariffs in the next three years, some will take effect in 2024.

Why Is There A Tariff Increase On Imports?

The tariff increase on Chinese imports is being implemented by the U.S. government to counter China’s unfair trade practices. Over the past few years, China has come under fire for practices such as intellectual property theft. Chinese companies that the government backs have been accused by the U.S. of stealing foreign technology and trade secrets. The companies then use the technology and trade secrets to reverse engineer products, cyber espionage, and force technology transfers. Another practice that has raised concern has been using state subsidies to give them an unfair advantage. These subsidies include the Chinese government providing financial support to domestic industries and lowering production costs.

Other unfair trade practices that the U.S. has accused China of include currency manipulation and dumping. Dumping is the exportation of products that is lower than the production costs, which companies can do to undercut foreign competitors. China responded by firmly opposing the new tariffs, believing it goes against the U.S. president’s commitment to not “suppress and contain China’s development.” China’s Ministry of Commerce noted, “China will take resolute measures to defend its rights and interests.” The tariffs will cover $18 billion of imports in the clean energy and technology sectors.

The Categories That Will Increase Tariffs Include:

Steel and Aluminum – From 0 to 7.5% to 25% in 2024.

Semiconductors – from 25% to 50% by 2025.

Electric Vehicles (EVs) – from 25% to 100% in 2024.

Batteries, Battery Components and Parts, and Critical Minerals – from 7.5%% to 25% in 2024

Solar Cells – from 25% to 50% in 2024.

Ship-to-Shore Cranes – from 0% to 25% in 2024.

Medical Products – from 0% to 50% in 2024.

There has been a notable increase in Chinese-produced EVs (electric vehicles) from 25% to 100%. This is to protect the U.S. from the surge in Chinese EV imports. From 2022 to 2023, EV imports from China rose nearly 70%.

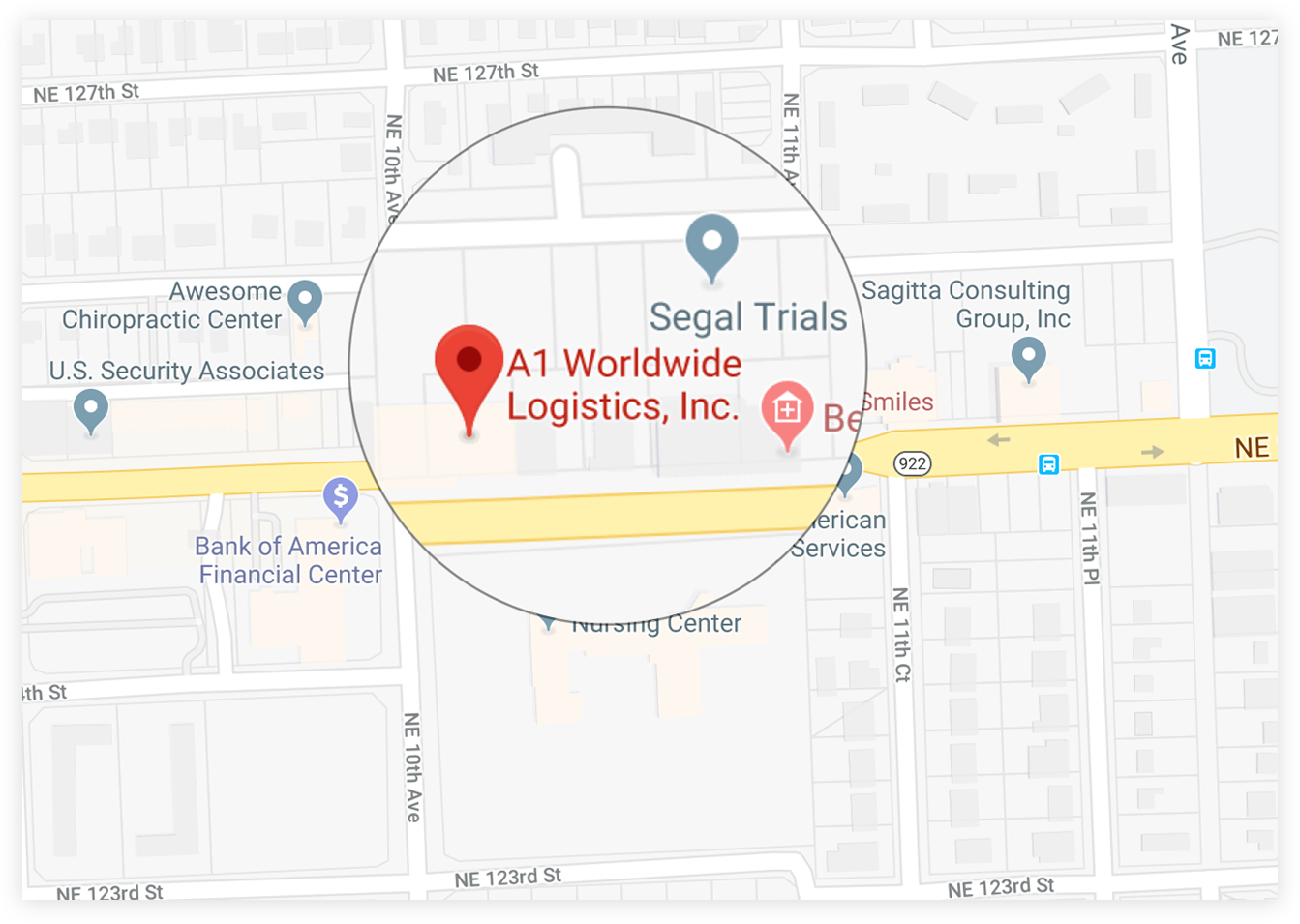

A1 Worldwide Logistics

When shipping cargo internationally, situations may arise, such as a tariff increase that can affect your shipment. Being informed and well-prepared for these circumstances is essential in preventing significant backlogs in your supply chain. Using the assistance of a 3PL (third-party logistics) provider is ideal when starting. 3PLs handle numerous parts of a shipper’s supply chain, including international and domestic shipping, warehousing, customs brokering, etc. They also educate you on the best course of action when shipping. To speak to a 3PL company regarding broker importing into the U.S., reach A1 Worldwide Logistics at 305-425-9456 or info@a1wwl.com. We have freight forwarders and customs brokers that can ensure that you meet your goals.

1035 NE 125th St Suite #320, North Miami, FL 33161.

1035 NE 125th St Suite #320, North Miami, FL 33161. a1worldwidelogistics.com

a1worldwidelogistics.com (305) 821-8995

(305) 821-8995 Hours: 8AM - 5PM

Hours: 8AM - 5PM