Trump Is Imposing Tariff Hikes

Share Article in Social Media

A Monday announcement by the Trump administration revealed that President-elect Donald Trump is imposing tariff hikes on imports. On January 20th, Trump will impose a 25% tariff increase on all goods entering the U.S. from Canada and Mexico. The executive order also includes an additional 10% tariff on imports from China. Before the November 5th election, the Biden administration finalized a tax hike on China imports, which included:

- Steel and Aluminum – From 0 to 7.5% to 25% in 2024.

- Semiconductors – from 25% to 50% by 2025.

- Electric Vehicles (EVs) – from 25% to 100% in 2024.

- Batteries, Battery Components and Parts, and Critical Minerals – from 7.5%% to 25% in 2024

- Solar Cells – from 25% to 50% in 2024.

- Ship-to-Shore Cranes – from 0% to 25% in 2024.

- Medical Products – from 0% to 50% in 2024.

The Trump administration is potentially adding to the hike with talks of a 60% tariff hike for China-made imports. More recent tariffs for Mexico and Canada imports could result in a return to a trade war for the countries. During Trump’s first presidency, tensions were already high between the North American countries. In 2018, a USMCA trade agreement ended the past conflict. With Mexico and Canada being the two top trading partners, a tariff increase can significantly impact trade and resume tensions.

Why Is Trump Imposing Hikes On Tariffs?

The reason behind the sudden increase in tariffs is to stop drugs and illegal migrants into U.S. borders. “As everyone is aware, thousands of people are pouring through Mexico and Canada, bringing crime and drugs at levels never seen before.” The 10% China tariff increase is to stop the flow of fentanyl into the U.S. Another goal behind the rise is to have production come back to the U.S. By making imports more costly, customers may begin buying goods domestically. The president-elect believes creating new factory jobs will reduce the federal deficit and lower food prices. Economists have the opposite view, noting that tariffs are inefficient for the government in raising money.

What Can This Mean For International Shipping?

Due to the high traffic that the U.S. imports and exports from China and Mexico, tariffs will directly affect shipping. As previously mentioned, tensions from the trading partners may escalate and lead to other consequences. The Mexican president, Claudia Sheinbaum, said, “Trump’s threats to impose tariffs could generate inflation and job losses in both countries.” As a result of the hikes, the North American countries could soon make their retaliatory tariffs on U.S. exports. This may lead to shippers facing additional costs for importing and exporting internationally. Companies in the U.S. are already preparing for an increase in duties by reducing their sourcing from China.

Retailers and manufacturers in the U.S. that rely on outsourcing from foreign countries could soon be devastated by the hikes. Regular shippers may also feel the strain and should take preventive measures to protect their shipments. An ideal way to ensure their cargo ships internationally is by contacting a 3PL (third-party logistics) company. 3PLs provide various solutions for outsourcing a supply chain, like brokerage, freight forwarding, coordination, warehousing, and knowledge. A 3PL provider like A1 Worldwide Logistics understands what to expect when transporting cargo and guides you through the process. Reach us at 305-425-9456 or inf@a1wwl.com to determine the best course of action for your shipment’s success.

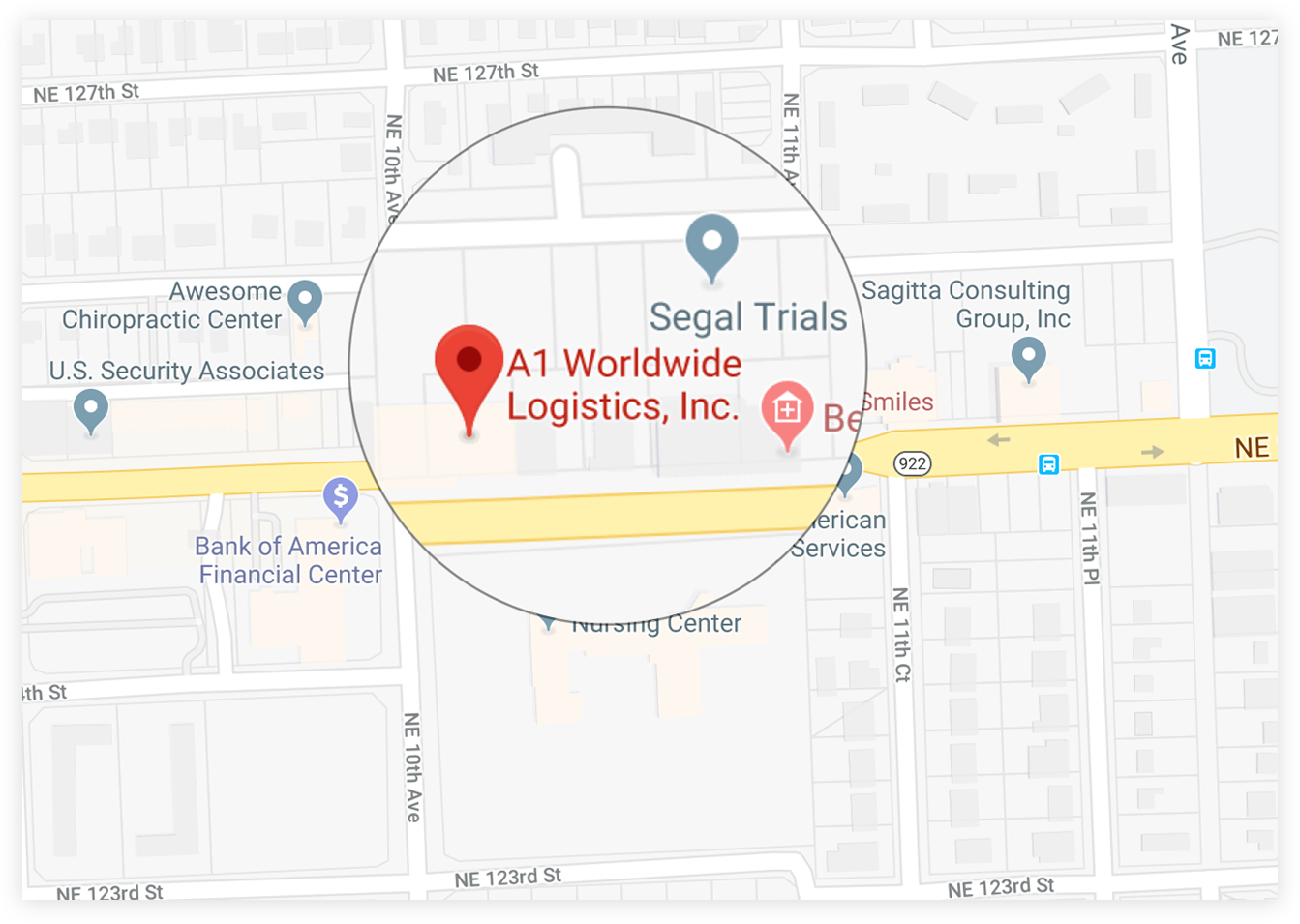

1035 NE 125th St Suite #320, North Miami, FL 33161.

1035 NE 125th St Suite #320, North Miami, FL 33161. a1worldwidelogistics.com

a1worldwidelogistics.com (305) 821-8995

(305) 821-8995 Hours: 8AM - 5PM

Hours: 8AM - 5PM