What Are Free Trade Zones?

Share Article in Social Media

A common question that new shippers tend to ask themselves when starting is what are free trade zones (FTZs). FTZs are specialized locations where shippers can import, re-export, manufacture, and store shipments with limited involvement of customs agencies. FTZs may also have extensive manufacturing facilities where companies import raw materials rather than ship finished products. These zones are usually around major seaports, airports, or areas with geographical advantages to trade. For example, the Colon Free Zone is near the Panama Canal and is the largest FTZ in the Western Hemisphere. Although there are similar areas globally, this article will focus on U.S. FTZs, known as foreign-trade zones.

In the U.S., FTZs began with the Foreign-Trade Zones Act of 1934, which helped encourage foreign commerce. The U.S. Customs and Border Protection (CBP) enforces import laws and monitors zone activities. Today, there are 298 FTZs located near throughout the 50 states. The U.S. further breaks the areas down into two types: general-purpose zones and subzones. A general-purpose zone is a location like a port or industrial park available to the general public. Subzones are private sites that a single company uses for a specific purpose. Compared to General-Purpose Zones, all financial responsibilities go to the single company with the permit.

How Can A Shipper Benefit Knowing What Are Free Trade Zones?

FTZs have numerous advantages when importing goods into the U.S. One of the most significant benefits is the cost savings the shipper can have. When merchandise is in the zone, it is exempt from customs duties and exercise tax. Duties only have to be paid by the importer when the cargo leaves and enters the local market. No duty payments are also needed if the shipper exports the product in FTZ. FTZs also allow for cost reduction by reducing merchandise processing fees (MPF) and inverted tariffs. An inverted tariff is when raw materials have a higher duty rate than the finished product. In FTZs, you can pay the lower rate.

An FTZ has many logistics benefits for a supply chain. Since CBP does not subject FTZs to duties, importers can use them to repair, inspect, and remove defective products. Companies that import and export large amounts of products benefit considerably from cost savings. FTZs also can help streamline supply chains by allowing for direct delivery. Direct delivery is when an import can go directly to the location in the FTZ without customs approval. Businesses with a substantial number of shipments often use this for quickness. Zone-to-zone transport of shipments is also possible free of customs duty payments since the cargo moves “in-bond.”

Customs Bonded Warehouse

When shipping goods internationally, it is essential to take proper precautions to ensure the success of a shipment. Along with FTZs, shippers have significantly benefited from using a customs-bonded warehouse. A bonded warehouse allows freight storage without paying taxes for up to five years from the import date. This allows the importer to look for customers and save money before they have to pay taxes for the shipment. You can also re-export the shipment free of tax payments during that time. Contact A1 Worldwide Logistics at 305-821-8995 or info@a1wwl.com to learn about our bonded facility.

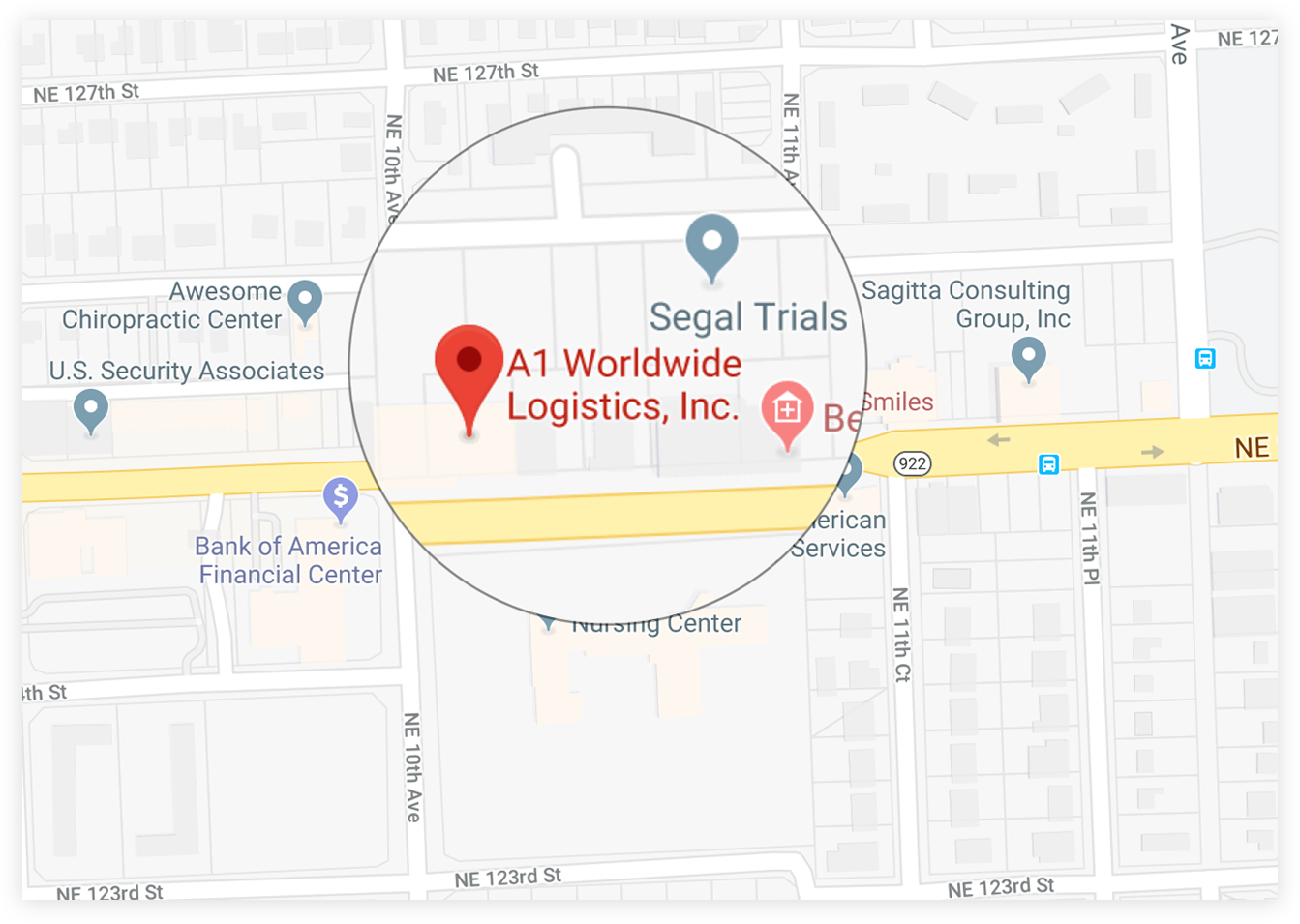

1035 NE 125th St Suite #320, North Miami, FL 33161.

1035 NE 125th St Suite #320, North Miami, FL 33161. a1worldwidelogistics.com

a1worldwidelogistics.com (305) 821-8995

(305) 821-8995 Hours: 8AM - 5PM

Hours: 8AM - 5PM